In Part 1, I teed up a couple of related digital concepts:

- Personalization. A good example of this is Shein. They are taking personalization further up the supply chain to product development. This, in theory, can become the “market of one”.

- Economies of Scope (vs. Scale). Good examples here are Unilever and Sony.

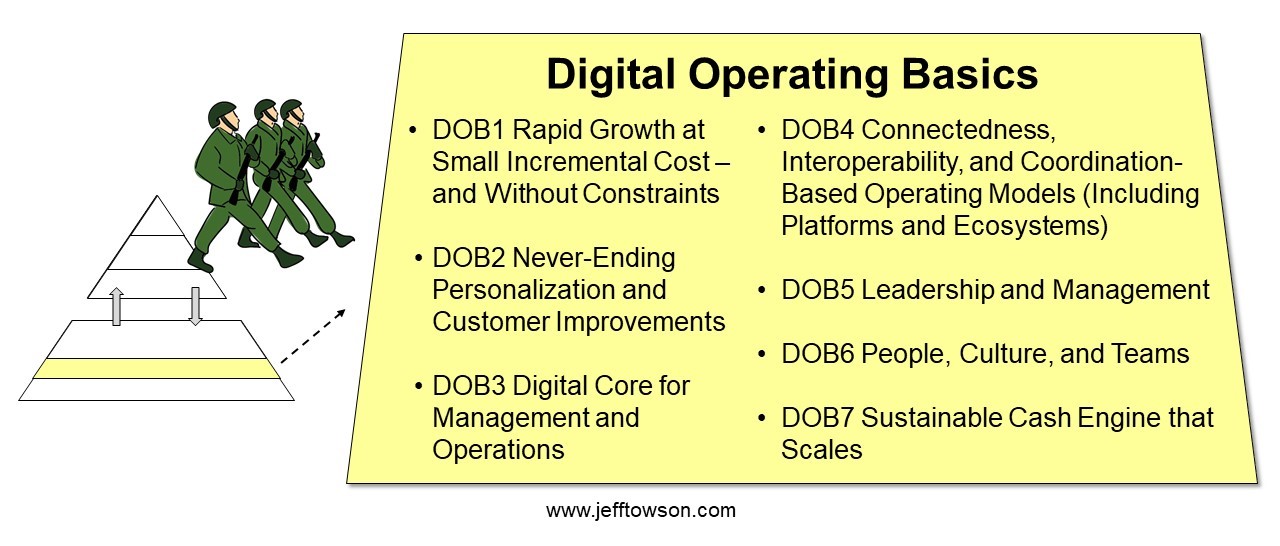

- Improving the user experience. This is Digital Operating Basics #2. Good examples here are Alibaba, Coupang, Xiaomi and (maybe) Twitter.

In this article, I want to talk about how the bar is being raised for improving user experience (i.e., the third point). Advancing the user experience is where more and more of competition is being decided. It is where certain management teams are distinguishing themselves. And it is where I am increasingly looking to determine who is going to have better future operating performance. And who is going to win. And yes, personalization (the first point) is a subset of never-ending improvements in the user experience. It’s why I put them together in the digital operating basics as DOB2. But you can only personalize so much. Improvements in the user experience can go on forever (depending on the type of business). It’s the deep well of operating performance.  But first…

But first…

Why I Was Not Optimistic About Shein Long-Term. But Am Re-Assessing.

Online cross-border retailer Shein is often pointed to as a good example of data-driven personalization. That they are the “pioneer of ultra-fast fashion”. And that’s sort of true. Here’s how I view the company. Shein is mostly about being particularly innovative and early in DTC cross-border ecommerce. This is something founder Chris Xu is just really good at. After he graduated from a university in Qingdao, he did a short stint as a consultant in cross border ecommerce (doing search engine optimization). And he founded his first company Shein in 2008 with the same focus. He’s been this particular area for +15 years. With Shein, Chris focused on cross-border apparel. And he originally got traction selling wedding dresses and other “customized, special occasion apparel” from China to US consumers. Think wedding dresses, graduation dresses, bridesmaids, groom wear, and formal evening wear. It turns out people pay a lot for “special occasion apparel” and offering the China price can be particularly powerful here. You can see Shein is still following this basic playbook today. They target items where the low price of Chinese manufacturing is particularly attractive to American buyers. And they are really good at social media and digital marketing. I think that is a lot of their success. They are combining cross-border DTC apparel with surprisingly low prices and surprisingly effective digital marketing. Ok. So why was I not optimistic long-term? Three reasons. First, because what Shein is doing is pretty easy to copy. They had a first mover advantage in cross-border DTC ecommerce. That will fade in strength over time. Lots of companies can go direct to Chinese manufacturing. Second, their much cited strength in “data-driven personalization” will also be copied. Shein does personalization in (at least) three areas.

- Personalized marketing. They reportedly get most of their activity from Gen Z women, who are active on social media and TikTok.

- Personalized retail experiences for users, mostly in product selection.

- Personalized product development. They launch thousands of new products weekly based on what they think people will want.

That’s good. That is next level personalization. But all retail apparel brands will be doing this soon. The big reason I was not optimistic long term was because I didn’t see many avenues for ongoing improvements in the user experience. Shein was an ecommerce app for clothes. That is a limited user experience. There were no physical stores. There was no real content or community. The asset lite business model of DTC ecommerce apps is loved by investors. But it has few avenues to continually improve the user experience. However, I have had to revise this opinion with Shein’s recent moves into physical stores. They are now merging with retailer Fashion 21 in the USA. And they are opening stores in Japan and other places. That is really interesting. And I’m starting to see a path to “wow experiences”. And that is what I am looking for. That is really the new threshold for operating performance. And is the point of this article.

The Standard is Being Raised from Personalization to “Wow Experiences”

When I met with the CEO of beverage delivery service Ze Delivery in Brazil, my recommendation was he should look at his business as a never-ending process of experimentation and innovation to improve the user experience. They meant moving beyond just providing alcoholic beverages for delivery with a cool mobile app. Instead of staying focused only on convenience, big selection and low prices (a good start), they should also expand to events and user experiences. For example, they could:

- Identify 10-20 “in person” events or experiences in Brazil and customize products for those. Identify fun family and party events and support them with tailored product bundles.

- Provide additional services that complement their core beverage delivery. This could be everything from offering catering services to digital content (streaming football games).

But, overall, they should adopt a posture of continually thrilling and wowing their customers. And that means moving beyond just products to also events and occasions. That is the new standard for competition. You have to go way beyond just personalization. You have to constantly improve the user experience. All the time. Continually. It should never stop. And I pointed to Coupang and Xiaomi as examples of this posture.

Why I Like and Don’t Like Xiaomi

Chinese consumer products giant Xiaomi has really good management. I’ve written about CEO Lei Jun and his team quite a bit. They are really impressive in their operating performance. But they keep choosing really difficult businesses to go into. It’s really frustrating (for me). Their core business, smartphones and consumer electronics, is just a really hard business (if you don’t control the semiconductors or operating system).

- You have to keep developing new smartphones every year.

- You have to keep convincing customers to choose your phones over other devices.

It’s like being in Hollywood. You have to keep making hit movies year after year. And you have to spend tons on marketing to launch each one. User acquisition, engagement and retention in phones is even harder because people just don’t buy phones that often. And there are few switching costs or other real competitive advantages (beyond brand and marketing spend). As a result, Xiaomi floods money into marketing and design. And the management talks a lot about how they need to continually create products that “thrill” their customers”. They have to really stand out and impress their customers with their products. And, as these products go obsolete pretty fast, this never really ends. So they keep rolling out new products like smart chopsticks and smart air purifiers. Almost every time you walk into a Xiaomi store, you will find something new. It’s a tough way to live. Coca-Cola has none of the problems. But continually thrilling your customers is a good skill to have. And it is what Xiaomi has gotten good at in order to survive. I really like how their management openly acknowledges that they need to continually “thrill” their customers with their new products. Interestingly, their choice of a difficult business has made their strong in the key skill that most companies now need. FYI: Xiaomi’s latest move is into electric / autonomous vehicles. Another really hard business.

Coupang Sets the New Standard with “Wow Experiences”

Another company I like in this regard is South Korean ecommerce giant Coupang. Their management (also good) says their standard is to create “wow experiences” for their customers every day. That is their standard. That is how projects are assessed. It is how they measure their operating performance. That’s great. I think that is the best definition for this I have heard. They try to surprise and “wow” their customers literally every day. I like how they emphasize “every day”. For those not familiar, Coupang is basically a South Korean version of JD (or Amazon).

- It was founded in 2010 by Bom Kim, a Harvard Business School drop-out.

- It began as a group buying site and evolved into a more traditional online retailer. It has always focused only on South Korea.

- Note: South Korea has +51M people, with a GDP per capita of $44k. The geography is 60% mountainous with 81% of the population in cities.

- It has evolved into an online retailer plus marketplace business model. This is similar to Amazon and JD.

- It is well positioned to move into physical retail (like Alibaba).

Their stated value proposition is to “create ever-improving experiences at lower prices for customers”. That is an interesting variation on the normal pitch by ecommerce companies (convenience, lots of products, low prices). Note how they use the phrase “ever-improving experiences.” Here is how they talk about wowing their customers.

- “We are committed to delivering a “wow” experience to all of our customers every day.”

- “This commitment drives every aspect of our operations and pushes us to redefine the standards of e-commerce.”

Those are my two standard examples for this point. That personalization is not enough. You need wow experiences. Forever.

Experiential Retail is the New Frontier for “Wow Experiences”

Ok. Last point on this. This is why Alibaba is really the leader in constantly improving the user experience. They are the most aggressive ecommerce company in terms of combining physical and online retail. And that puts them in a great position to do lots of experimentation and innovation in the user experience. They are rolling out new retail formats all the time. They are testing new use cases in their Freshippo and Sun Art stores. Alibaba is also why I’m not super excited about Shein. Being only a cross-border DTC app, I just don’t think they have these types of opportunities to continually improve the user experience. Here is a retail store in Beijing, where Alibaba is putting in interactive screens to change the user experience.  You can also look at JD for how experiential retail is changing the game. They are doing some cool targeted experiments in this area. A few years back, I wrote about my visit to JD’s e-space in Chongqing, which was basically a shopping mall that has been digitized. It was not a clear home run. But it showed they are doing lots of trials in the user experience. And when they talk about this, the phrase they use is “experiential retail”. Here is my trying out a NineBot scooter in their e-space.

You can also look at JD for how experiential retail is changing the game. They are doing some cool targeted experiments in this area. A few years back, I wrote about my visit to JD’s e-space in Chongqing, which was basically a shopping mall that has been digitized. It was not a clear home run. But it showed they are doing lots of trials in the user experience. And when they talk about this, the phrase they use is “experiential retail”. Here is my trying out a NineBot scooter in their e-space.  So, if the new game is to constantly improve the user experience and to “wow” your customers. You probably need content, community, or a physical space to digitize. I think experiential retail is the most exciting of these.

So, if the new game is to constantly improve the user experience and to “wow” your customers. You probably need content, community, or a physical space to digitize. I think experiential retail is the most exciting of these.

Final Question: How to Identify the Winner in User Experience?

If constantly improving the user experience is a new dimension of competition, how do you tell which company is going to win? Which company is most going to improve the user experience over time? I look at:

- How many dimensions to the user experience can you build upon? There is not a lot to build upon when you are selling ketchup. The user experience simply doesn’t have that much to it. And consumers don’t care. But in other areas, like running shoes, it turns out there is a segment of users (runners) who deeply care about the subject. So, you can build out lots of content, services, and community.

- How many channels can you build upon? I mentioned that for Shein vs. Alibaba as an example here. They are in similar businesses (ecommerce), but one is building supermarkets and department stores that can be digitized. And the other is just an app.

- What is the proven management ability in this? Coupang and Xiaomi are both proven to be very good at this. Facebook, Airbnb, and others are particularly weak at this.

- How fast is management at this? That is what Elon Musk talks about. Maybe it’s all just about the pace of experimentation over time. Maybe it’s just about trying lots and lots of stuff and seeing what works. You can see him currently doing this with Twitter. He is changing the user experience almost every week. New features keep coming out.

Those are my 3-4 metrics right now. But I do think this is going to be the new standard for operating performance. Not personalization. It whether a company continually thrills and wows its customers? But I’m still working on metrics for this. That’s it for these 3 digital concepts:

- Personalization. A good example of this is Shein.

- Economies of Scope (vs. Scale). Good examples here are Unilever and Sony.

- Improving the user experience. This is Digital Operating Basics #2. Good examples here are Alibaba, Coupang, Xiaomi and (maybe) Twitter.

Cheers, Jeff