I keep an eye on the larger moves by Alibaba. Not the constant stream of announcements and endless initiatives but the larger strategic moves that I think will change the trajectory of the company. This usually means talking with management when I can and following the investor days. A couple of years ago, Maggie Wu (CFO) and Daniel Zhang (CEO) outlined Alibaba’s 11 growth strategies. This has been my go to list for this. I thought I would go through that today. Alibaba and Amazon both sort of obscure their strategy. I’m convinced Amazon does it on purpose. Their annual reports are the worst. For Alibaba, it’s more because the company has become really complicated. And they tend to change their terminology. They use terms like the Alibaba Digital Economy. I like their strategy but I think it is somewhat buried underneath jargon. So the follow is my translation of what I think they are doing. I’ll list the 11 growth strategies and my 3 main take-aways.

Take-Away 1: Alibaba’s Vision is Mostly a Big Marketplace Platform

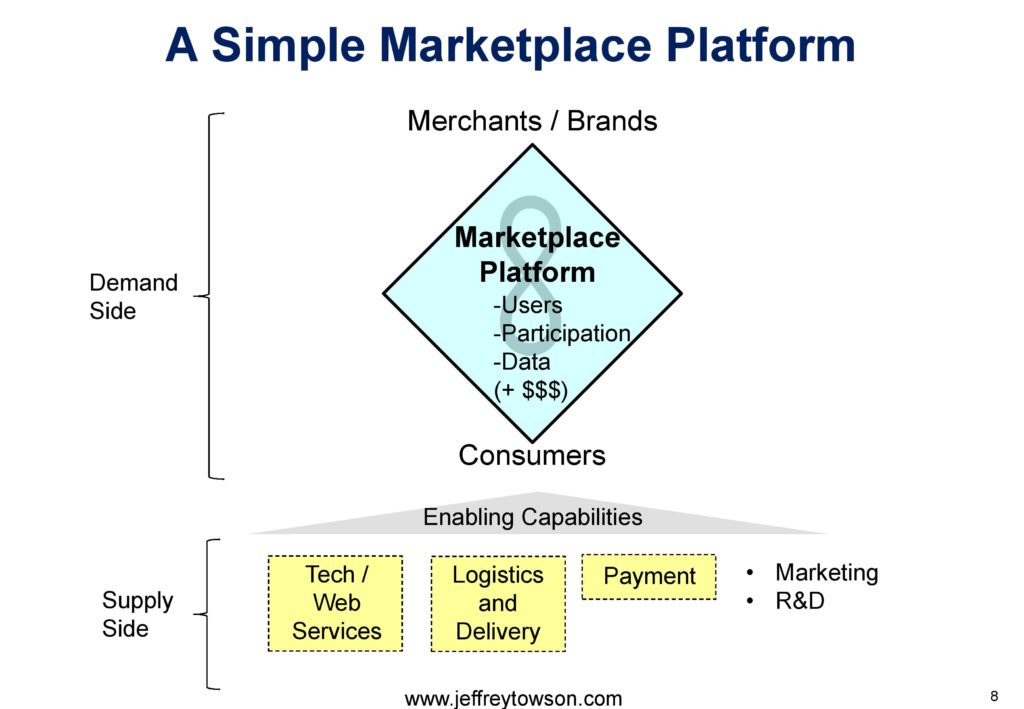

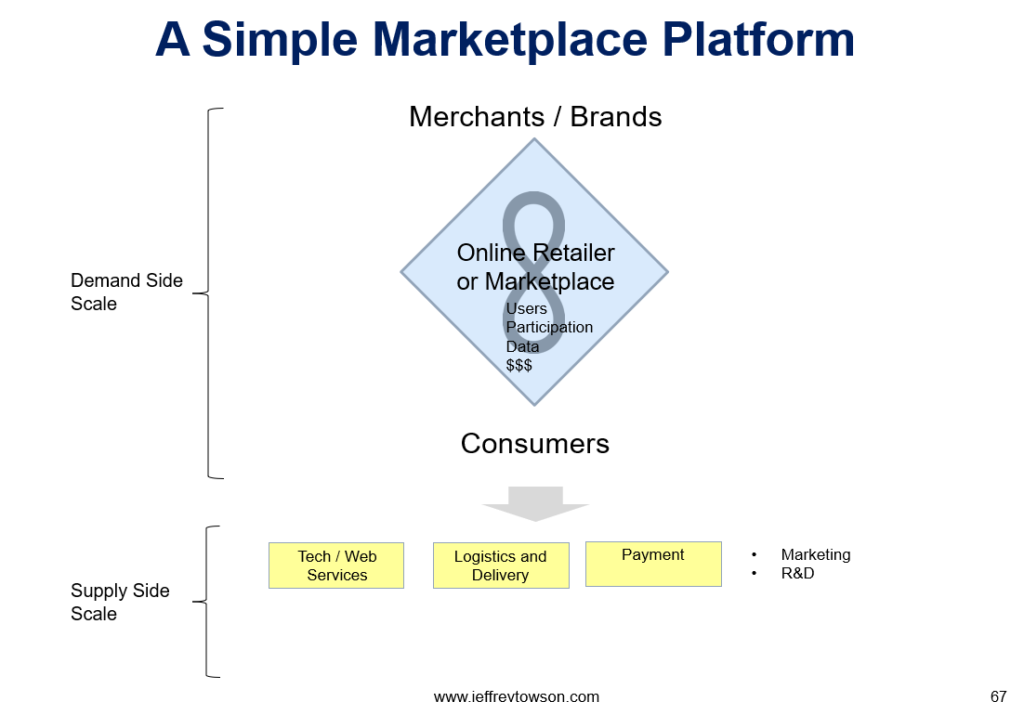

Below is the slide CEO Daniel Zhang presented for the long term vision (by 2036) for Alibaba.  We’ve seen versions of this for years. The target numbers get increased but it’s usually the same metrics. Recall, my basic marketplace platform chart:

We’ve seen versions of this for years. The target numbers get increased but it’s usually the same metrics. Recall, my basic marketplace platform chart:  I’ve argued you build a platform with four assets:

I’ve argued you build a platform with four assets:

- Users

- Participation / engagement

- Data

- Operating cash flow

If you look at the big goals for Alibaba, they clearly identify their two primary user groups as consumers and SMEs. And they tell you how many they want on their platform by 2036. All the other user groups (content creators, banks, insurance companies, asset management companies, etc.) also matter but they are not the foundation of Alibaba. It is also worth noting that China has 1.2B consumers if you don’t count kids and the very elderly. So Alibaba is planning to get another 800M consumers from somewhere. SE Asia is the primary target. India was a major target but that is pretty much closed off now. So it’s sort of a mix of Russia, Eastern Europe, Latin America and some other places. But I’ve never been sure exactly how they get 2B as a target. The focus on SMEs (brands and service companies too, not just merchants) is also important. They have always been focused on building digital tools for small companies and brands. Not just for the big and famous companies. This is always presented as empowering SMEs and “leveling the playing field”. This is true. But it’s also because you can’t been a powerful marketplace without lots of small, hopefully differentiated merchants. Getting to 10M SMEs would be impressive. That would be the world’s biggest shopping mall by far. And this is actually easier than the consumer target. The entire world wants to sell to Chinese consumers. So they can go anywhere in the world and connect them with their China base. When discussing growth, Daniel presented the following chart:  The first thing to point out here is what they mean by growth. Investors will usually think of this as revenue. But their core assets are users, participation, data and cash flow. So growth requires doing different activities to get growth in each of these assets. So they may look for growth in users, which means doing completely different initiatives for consumers vs. merchants. And growth may mean data, even if it means no direct revenue. Platforms increase in value by enabling interactions. That’s really what we mean by growth. And hopefully that translates to cash flow (but now always). The third pillar of Alibaba’s growth strategy is globalization and that is the simplest one. Because most of what they are talking about is SE Asia. That’s Lazada and lots of ties with the merchants of China. It also means AliExpress, which does cross-border B2C ecommerce. That has long been a mix of countries like Spain, Italy, Poland and (until recently) Russia. I find AliExpress the hardest part of their business to predict. And finally there is Alibaba,com, which does cross-border B2B ecommerce. Here’s the slide Daniel presented:

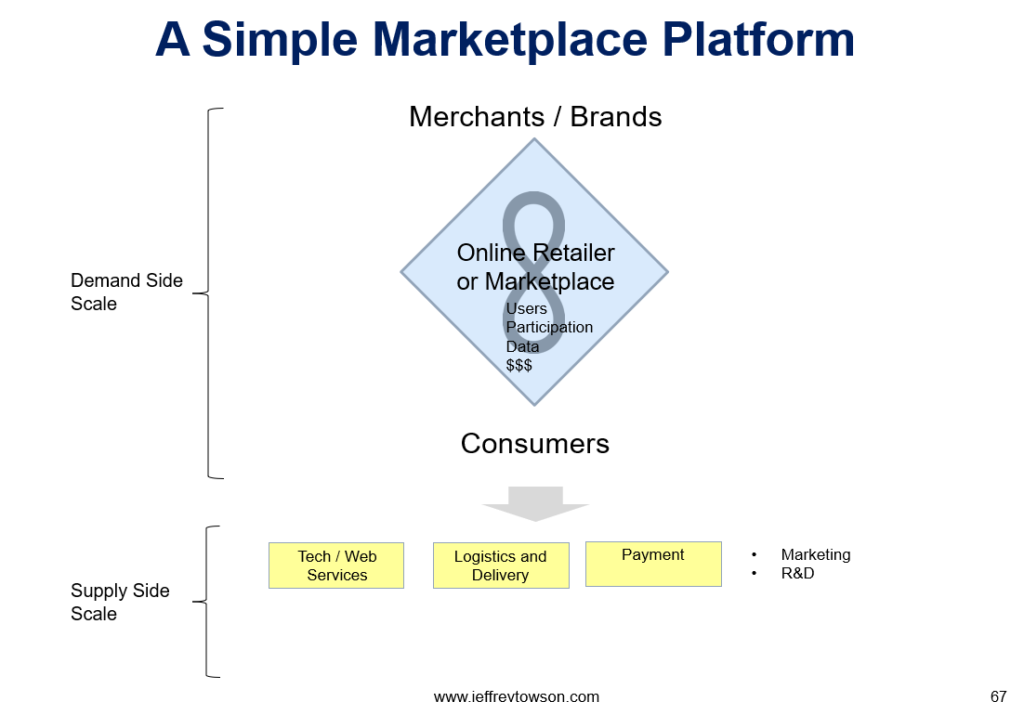

The first thing to point out here is what they mean by growth. Investors will usually think of this as revenue. But their core assets are users, participation, data and cash flow. So growth requires doing different activities to get growth in each of these assets. So they may look for growth in users, which means doing completely different initiatives for consumers vs. merchants. And growth may mean data, even if it means no direct revenue. Platforms increase in value by enabling interactions. That’s really what we mean by growth. And hopefully that translates to cash flow (but now always). The third pillar of Alibaba’s growth strategy is globalization and that is the simplest one. Because most of what they are talking about is SE Asia. That’s Lazada and lots of ties with the merchants of China. It also means AliExpress, which does cross-border B2C ecommerce. That has long been a mix of countries like Spain, Italy, Poland and (until recently) Russia. I find AliExpress the hardest part of their business to predict. And finally there is Alibaba,com, which does cross-border B2B ecommerce. Here’s the slide Daniel presented:  For those of you in SE Asia, look at the language they use. A “digital ecosystem” that integrates “commerce, financial services, and logistics”. That is Lazada and that is exactly the blue diamond chart I just showed you. They are running their core Alibaba playbook from China across SE Asia. That makes them very predictable in this region. For all their talk about a digital economy and 11 key strategies under 3 growth dimensions, this is basically a big marketplace platform strategy. That’s my first take-away. One place I thought this really came out was in CFO Maggie Wu’s discussion about their M&A activity. Ignore all the famous names in their deals. Look at the descriptions they put at the tops of the columns.

For those of you in SE Asia, look at the language they use. A “digital ecosystem” that integrates “commerce, financial services, and logistics”. That is Lazada and that is exactly the blue diamond chart I just showed you. They are running their core Alibaba playbook from China across SE Asia. That makes them very predictable in this region. For all their talk about a digital economy and 11 key strategies under 3 growth dimensions, this is basically a big marketplace platform strategy. That’s my first take-away. One place I thought this really came out was in CFO Maggie Wu’s discussion about their M&A activity. Ignore all the famous names in their deals. Look at the descriptions they put at the tops of the columns.  The left column is basically the capabilities I put at the bottom of my charts (i.e., yellow boxes).

The left column is basically the capabilities I put at the bottom of my charts (i.e., yellow boxes).

- Ant Group (payment / financial services)

- Cainiao (logistics and delivery)

- Ali Cloud (IT / Web Services but no deals listed)

- AliHealth. Not sure I understand this.

But these are considered “strategic businesses”. When they buy something here, they are adding to the infrastructure that supports their marketplace.  The acquisitions / investments in the middle are:

The acquisitions / investments in the middle are:

- “New User Acquisition”, which is about bringing more SMEs and consumers onto the platform.

- “User Experience Enhancement” which is about increasing the value they offer to the users. I talked about this in my article about Ant and the Sustained Innovation Trap of Network Effects. The way you keep users engaged and participating on your platform is by continually adding value and enhancing their experience.

- “Business Digitalization” is pretty much the same thing but for merchants. It’s about adding more and more digital tools for merchants. This is discussed below.

Finally, we have the right column which is labeled “Tap Into New Sectors”. These are their bigger moves to bring new categories of users and services onto the platform. And maybe even create new platforms. This list has their investments in auto and real estate companies. Overall, I think my simple chart captured the core of their strategy pretty well. Ok. Next point.

Take-Away 2: Forget the “Alibaba Digital Economy”. They Are Building Complementary Platforms.

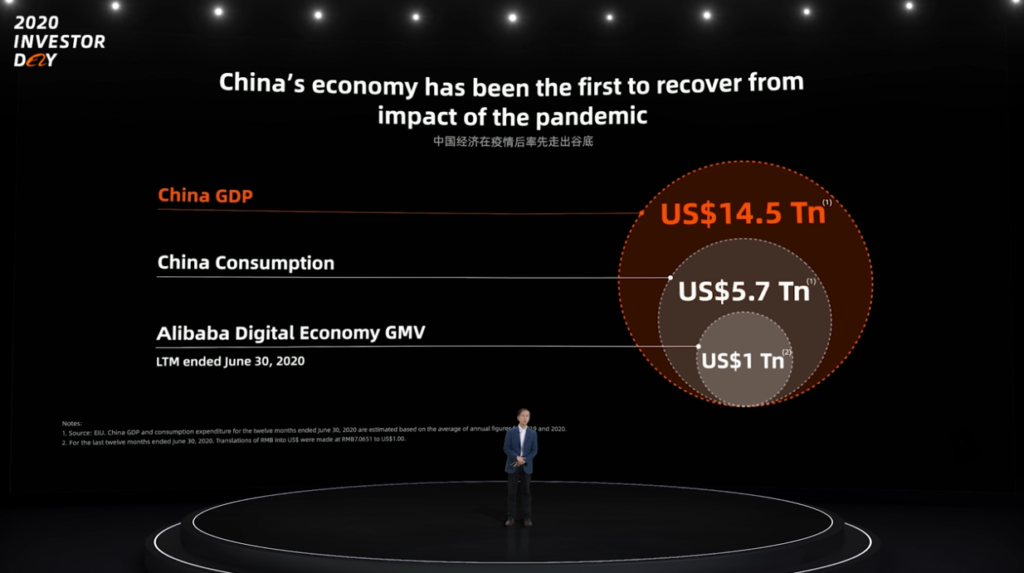

This is where it starts to get more complicated. Because besides globalization, they listed 10 other growth strategies under the headings of Domestic Consumption and Cloud Computing and Data Intelligence (i.e., Alibaba Cloud). And they started by giving a bunch of numbers for their digital economy.  The number being repeated from this chart is $1T in GMV. Alibaba has already passed $1 trillion in GMV (gross merchandise value) sold on their platforms. And this is a target they long talked about as a goal. This chart is useful in pointing out that this is huge business. China consumption (i.e., retail) is +6T and +25% of this is online. Keep in mind, if you add up all the spending from ecommerce in the next 10 countries (including the USA), it is less than this. Domestic ecommerce in China is absolutely huge. And Alibaba is the biggest player. But you should really ignore all this. And their “digital economy” idea is not helpful. What you really want to focus on are the 5 strategies they list for Domestic Consumption.

The number being repeated from this chart is $1T in GMV. Alibaba has already passed $1 trillion in GMV (gross merchandise value) sold on their platforms. And this is a target they long talked about as a goal. This chart is useful in pointing out that this is huge business. China consumption (i.e., retail) is +6T and +25% of this is online. Keep in mind, if you add up all the spending from ecommerce in the next 10 countries (including the USA), it is less than this. Domestic ecommerce in China is absolutely huge. And Alibaba is the biggest player. But you should really ignore all this. And their “digital economy” idea is not helpful. What you really want to focus on are the 5 strategies they list for Domestic Consumption.  This slide is important but confusing. I’m just going to translate what I think it really means.

This slide is important but confusing. I’m just going to translate what I think it really means.

“To continue growing our digital economy user base”

This is increasing the number of consumers and the number of SMEs on the platform. But how are they doing this? It is actually a long list of initiatives across their multiple platforms (Taobao, Tmall, Ant Group, Cainiao, Youku, Alipay, etc.). But anytime they bring a user onto any of these platforms, they can start to cross-sell other services. One of the big benefits of having multiple complementary platform business models is the ability to share users and data. Some examples of how they are growing users:

- New Retail, such as their Freshippo supermarkets. These OMO (online-merge-offline) retail plays are a lot about bringing physical merchants onto the platform. Retail in China is only 25% online. They want the other 75% on the platform – and that means digitizing and connecting all those convenience stores, grocery stores, restaurants and so on. That is why new retail is really about a quantum jump in the number of users on the marketplace.

- Daily Life Services, which was Ele.me and Ant Group. This is about lots of local services companies joining as users. Think beauticians, restaurants, movie theaters, etc.

- Digital finance companies, such as insurance companies, banks, and asset management companies.

You can see they are expanding their user numbers in multiple directions.

“To expand consumption categories and consumer wallet share in our digital economy”.

This is basically more participation and more types of transactions. Once you get users on the platform, you want them to do more and more things. So you bring in new product types, new services and new digital goods. Platforms are built on users, engagement, data and cash flow. Well, #1 above was about growing users. This is about growing engagement, which gets you more data and money. This is also different than the fight for attention at companies like Tencent, Facebook, and TikTok. On the consumer side, Alibaba is ultimately fighting for share of wallet. That is their total addressable market. And unlike the number of hours in the day, the amount of money in China keeps increasing.

“To develop new supply categories and supply-side transformation based on consumer insights.”

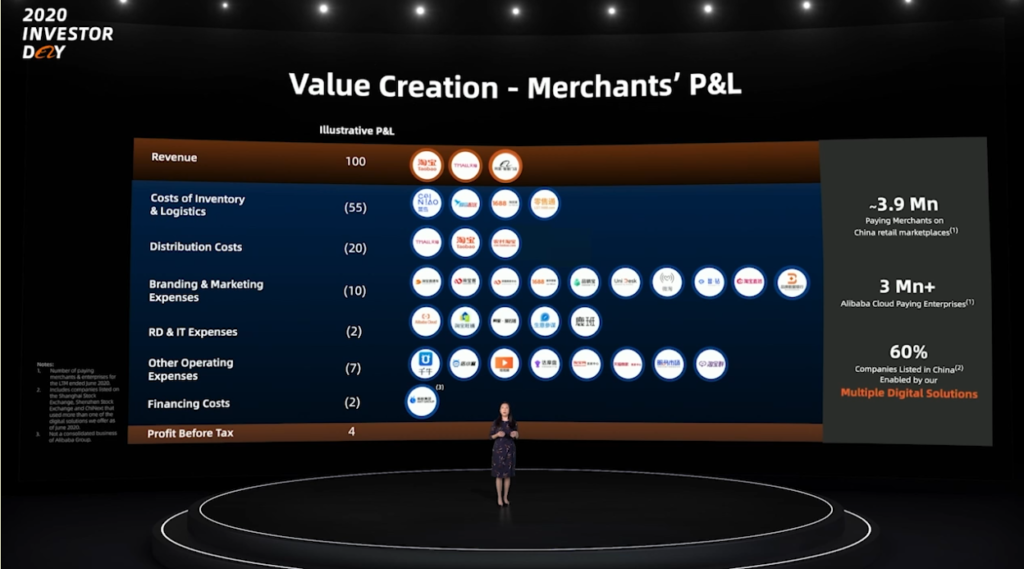

Ok. This one is complicated. There is a ton of thinking baked into this point. If #2 was about getting more engagement and share of wallet from consumers, this is about getting more engagement and money from SMEs. What is the total addressable market for merchants / SMEs? It isn’t money in the wallets of consumers where you get a percent of money spent. It is the value you add to the operations and income statements of SMEs. Here is the key slide from Maggie Wu.  Look at the left column, where it shows a model P&L for a typical merchant. For $100 in revenue, the merchant spends $55 on inventory and logistics. They spend $20 on distribution. $10 on branding and marketing. $2 on R&D and IT. And so on. This is the key question. How much value can Alibaba add to merchants? How much can they decrease their costs? How much can their improve their operations? Their productivity? Because they generally take a small percentage fee from the value of the services they provide. It’s a take-rate of a few percent. And the more value they add to merchants businesses, the larger that number becomes. So that model income statement is their total addressable market on the merchant side. That is what they are trying to impact. And that is what they mean by “supply-side transformation based on customer insights”. Some examples:

Look at the left column, where it shows a model P&L for a typical merchant. For $100 in revenue, the merchant spends $55 on inventory and logistics. They spend $20 on distribution. $10 on branding and marketing. $2 on R&D and IT. And so on. This is the key question. How much value can Alibaba add to merchants? How much can they decrease their costs? How much can their improve their operations? Their productivity? Because they generally take a small percentage fee from the value of the services they provide. It’s a take-rate of a few percent. And the more value they add to merchants businesses, the larger that number becomes. So that model income statement is their total addressable market on the merchant side. That is what they are trying to impact. And that is what they mean by “supply-side transformation based on customer insights”. Some examples:

- Think about Cainiao and all the cost savings and other value that provides to merchants.

- Think about the Tmall Innovation Center (TMIC) which helps merchants study their customers and create new products in record time.

- There is Uni-Marketing, where Alibaba provides a data-rich dashboard for merchants to see the behavior of their current and potential customers.

- There are the supplier and consumer credit offerings of Ant Group.

- There is the data intelligence and operations of Ali Cloud.

- This is the new digitization of manufacturing at XunXi.

And so on. They are digitizing and transforming the supply side of retail, logistics and now manufacturing in China and internationally. At the simplest level, these activities are about merchants being more active on the platform. Providing them value, getting them engaged and keeping the network effect going. At the next level, these activities are about switching costs. They integrate operationally and technologically with merchants. As a marketplace platform, you want to be running the operating software and inventory management of local restaurants and stores. You want to provide data and insights that merchants rely upon. You want their operations hosted on your cloud. And so on. The more you can integrate with merchants in terms of data technology and operations, the greater the switching costs. But perhaps most importantly, these activities are about growing revenue. Taobao and Alibaba started doing B2C in 2003-4 and made money both by offering marketing services and by taking a small percentage of the transaction. Their “take rate” was likely 1-2% of all the GMV that passed through the platform. When all they were doing was marketing and transactions, their revenue was limited to a small take rate on that expenditure by the merchants. By increasing the services they offer to merchants, they can take a percentage of more and more of the income statements of merchants. Their total addressable market increases with the more value they add to merchants. That is what the Maggie Wu slide above shows. On the consumer side, Alibaba is trying to increase their share of wallet. On the merchant side, they are trying to increase their share of total company expenditures and effort in running a business. And they are growing both. Ok. that was complicated. The last two are simpler.

“To create or redefine online / offline retail formats leveraging our digital technology”

This is a sub-case of the previous point. They are experimenting with new retail (i.e., OMO) in supermarkets, shopping malls, fashion, mom-and-pop stores and other retail formats. The goal is to combine the physical and digital assets into one data-driven consumer experience. And also to increase the core assets of the platform:

- Users: This could definitely bring in tons of physical merchants as users.

- Engagement: A lot of these formats are not about consumers spending more. But about having a better experience. About engaging more. Enjoying it more.

- Data: Many of these new retail formats will not be cash cows. But they will capture data Alibaba does not have. An example is offline payments. If offline retailers are now on the platform, Alibaba will get a lot more payment data.

- Money: For sure.

“To upgrade Alipay from digital check out to digital check in.”

The language here is about “checking in” to Alipay whenever you need something. Basically, a super app like WeChat. Instead of just using Alipay when you “check out” and pay. No big deal.

Take Away 3: Alibaba is 5-6 Complementary Platforms. Think of a Pack of Super-Predators.

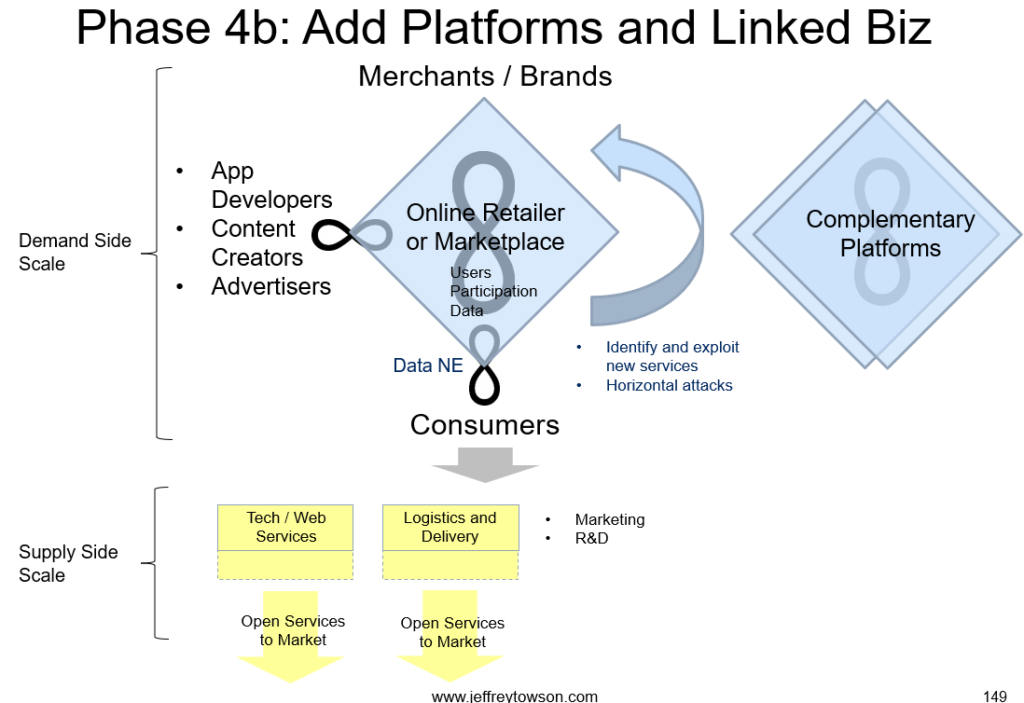

I have argued this is mostly about growing and improving their core ecommerce platform (i.e., blue diamond). And the three capabilities that support this are logistics, financial services, and IT / Web services (i.e., yellow boxes).  So you get lots of advantages on the demand side. Network effects, share of the consumer mind, switching costs. And in an age of abundance, capturing demand is critical. But you also get advantages on the supply side. Especially economies of scale in the big fixed costs, such as IT services and logistics and delivery. And by offering these capabilities to the market as new services, you can get even further economies of scale. I have called this externalizing capabilities. That is how their logistics and delivery capabilities became a separate business (Cainiao). And how tech / web services became Ali Cloud. And how payment became Ant Group. But it gets better. Because sometimes when you innovate and externalize, you don’t just get a new business with scale. You get a new platform business model. And that is really how Alibaba went from one marketplace platform to 5-6 complementary platforms.

So you get lots of advantages on the demand side. Network effects, share of the consumer mind, switching costs. And in an age of abundance, capturing demand is critical. But you also get advantages on the supply side. Especially economies of scale in the big fixed costs, such as IT services and logistics and delivery. And by offering these capabilities to the market as new services, you can get even further economies of scale. I have called this externalizing capabilities. That is how their logistics and delivery capabilities became a separate business (Cainiao). And how tech / web services became Ali Cloud. And how payment became Ant Group. But it gets better. Because sometimes when you innovate and externalize, you don’t just get a new business with scale. You get a new platform business model. And that is really how Alibaba went from one marketplace platform to 5-6 complementary platforms.  As mentioned, complementary platforms can be very powerful. If one platform business model is a super-predator. This is like a pack of super-predators hunting together. Ant Group is already there but being restructured. Cainiao is a work in progress. And Alibaba Cloud is where everyone is now focused. The rest of the 11 growth initiatives are in Cloud. That’s pretty technical. I go through that here. Overall, it’s a pretty amazing company. Lots of great lessons here.

As mentioned, complementary platforms can be very powerful. If one platform business model is a super-predator. This is like a pack of super-predators hunting together. Ant Group is already there but being restructured. Cainiao is a work in progress. And Alibaba Cloud is where everyone is now focused. The rest of the 11 growth initiatives are in Cloud. That’s pretty technical. I go through that here. Overall, it’s a pretty amazing company. Lots of great lessons here.